Welcome to our Quarterly Update

Welcome to our quarterly CFO Labs email. We have a jam packed edition this quarter! This edition includes 2 articles written for this issue for anyone serious about mine funding:

We’ve also put together a few new resources and updated our mining finance dashboard:

Oh did we also mention we’re running a public 2-day modelling course?

If you’re joining us for the first time, this is an email we send out quarterly to share valuable resources and insights on Resources/Mining Finance with our community. If you have any feedback/suggestions, or anything helpful you’d like to share with this group, please drop me a line.

Thanks to Rowen Cross and Crux Law for this fantastic article. Here’s the Executive Summary.

The story of the early stage developer is invariably one of capital constraints—exploration results are promising but cash is limited. Securing funding for early stage development is absolutely crucial, but it’s important that early stage funding doesn’t jeopardise future financing. Some of the early funding options available to unlock capital include:

Mineral rights agreements

Farm-in agreements

Royalties and streaming arrangements

Prepaid offtakes

Strategic joint venture investors

In the full article I explain all of these funding options and highlight the things to watch so that today’s funding decisions don’t become tomorrow’s funding roadblocks. Choosing the right funding path early on can shape the entire trajectory of a project. While each option offers its own advantages, they also come with trade-offs that can affect control, future financing, and long-term viability.

Crux Law is Perth’s independent finance law firm, helping businesses navigate every stage of the debt capital lifecycle with clear, strategic legal advice. Drop Rowen a line at [email protected].

Quarterly Mining Finance Dashboard

We’ve updated our Mining Finance Dashboard for the last quarter (with data sourced up to the end of July). If you haven’t seen this dashboard before, it’s an interactive way to look at:

Historical and forecast prices for a variety of commodities

Historical M&A mining transactions

Historical ECM mining transactions

Check out the dashboard here!

Copper and Gold leading the way…

Offtake Agreement Optimisation: How to Minimise Value Leakage

Thanks to Tate Advisory for this insightful article.

You’ve finalised your Bankable Feasibility Study (BFS) (or in some cases Feasibility Study) and are moving into financing mode. Depending on the market cycle, you may be either batting away financier interest with a stick, or out there banging the drum, or somewhere in between. You may be part way through the process and getting tired of balancing your day job with managing Q&A rounds and site visits, your team fatigued from data room requests. You just want to get financing closed.

Capital is king (lifeblood even) and will move you into the next phase, production is in sight. So, when a draft offtake agreement lands in your inbox, you want to get it done, a key condition precedent to financial close and drawdown squared away.

However, this is not the time to take your foot off the scrutiny pedal. As we know, offtake agreement terms dictate the revenue your project will earn and one of the two determinants of the net margin you/your shareholders will (eventually) bank. Ensuring you optimise primary and secondary commercial terms now can have a huge impact on cashflow and asset returns down the track, especially if the offtake agreement is beyond five years.

Here are some areas of focus to maximise your offtake margins:

If time is on your side, use it!

Understand the offtaker’s working capital access and how this could benefit you

Don’t ignore off-spec products and how the terms propose to deal with these scenarios when they present

Bear in mind the big-picture financing, and consider how the offtake terms enhance or hinder this

For long term contracts, consider price review provisions to ensure terms remain instep with market

Tate Advisory are passionate about offtake optimisation in particular as part of a financing package. For guidance on how you can optimise your offtake agreement negotiations drop them a line at [email protected].

Mining Scoping Study Model

For those of you who may have missed this, we recently launched a (free) Mining Scoping Study Model template in partnership with Money Of Mine.

Download the model here. Thanks to everyone who contributed to this template!

Hint: You can replace the word “Vibranium” with “Gold” for something more real-life

Budgeting and Planning for Mining | Best Practice

Thanks to Andrew Newton and Ben Talbot for putting this white paper together.

Is your budgeting process slow and cumbersome, does it create lots of internal noise and conflict, is the resultant budget respected by the organisation?

We present our guide to best-practice business planning, which gets your organisation to the right answers as efficiently as possible.

The guide is full of hard-won wisdom based on our experience delivering planning processes from within organisations and our observations as consultants brought in to play the role of outside help. Although your organisation likely does some parts well, we have yet to see an organisation hit all of the high points contained in the guide.

Download the paper here.

Andrew is a Senior Finance executive with over 30 years experience in the mining and minerals processing industry working primarily in the Business Planning and Analysis field. He has extensive experience, working for major companies including Rio Tinto, Fortescue and Mineral Resources across a range of commodities including Iron ore, Bauxite, Alumina, Aluminium, Diamonds and Lithium .

Ben is a Partner at Model Answer who has worked in resources for over 20 years. His experience spans junior Explorers through to working with the Majors. Ben has worked in most commodities and has experience in Finance and Operations. Most of his work has centred around strategy, analytics, modelling and operational optimisation.

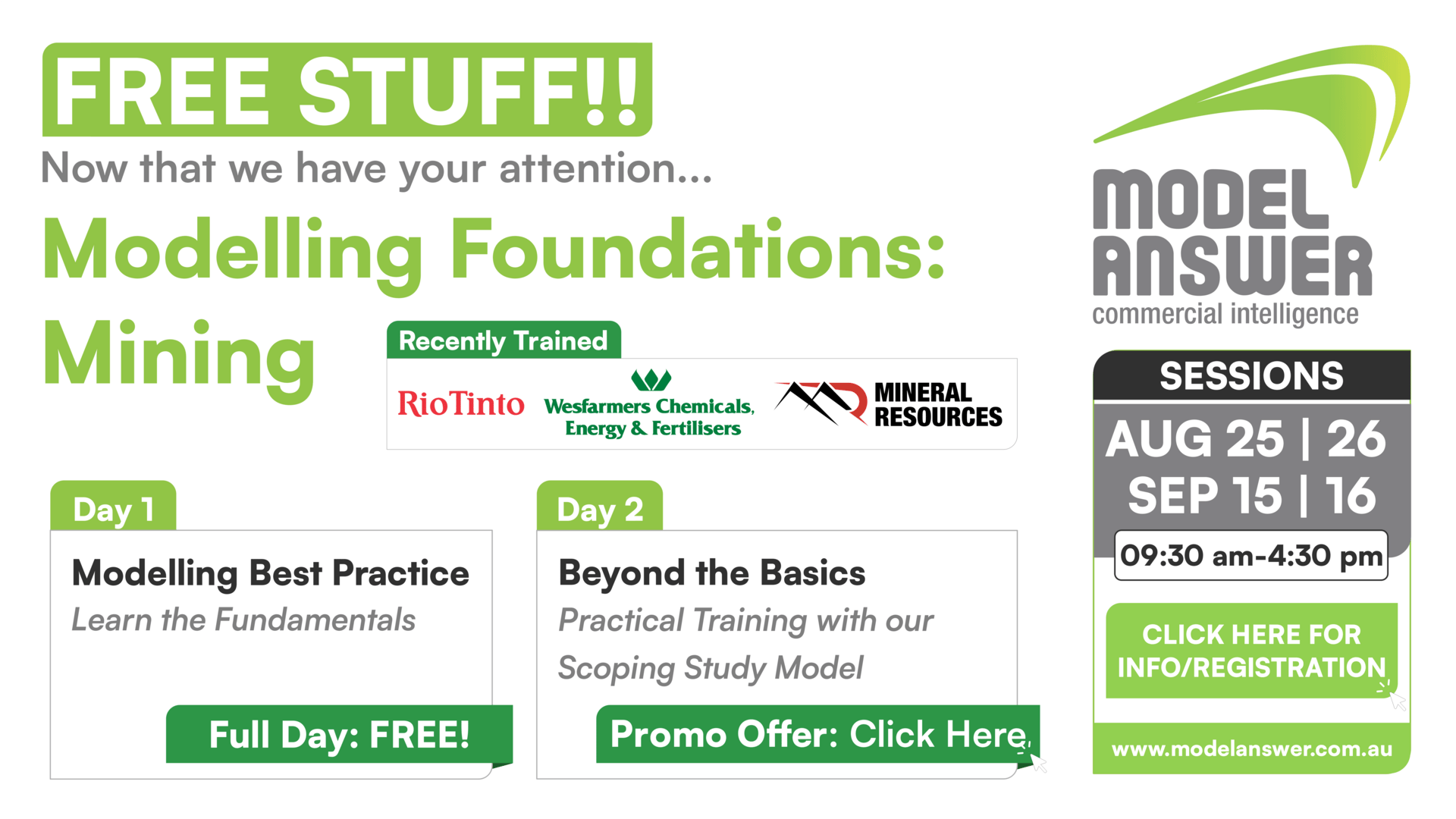

Training | Modelling Foundations: Mining

We usually deliver custom training for corporate clients rather than provide public training. However, seeing as we just released a scoping study model template, we decided to put together a training course specifically designed around it!

The course is rapidly filling up but please add yourself to the waitlist if your desired session is full and we’ll see what we can do to get you in. Register here.

What a crazy deal!

Mining Debt Transaction Dashboard

Just for kicks we recently put together a Mining Debt Dashboard comprising mining debt transactions over the last few years. We’ll aim to release this quarterly in line with our standard Mining Finance Dashboard if people find this helpful.

If you find this useful and have any feedback/requests on where we should go with this next, please drop me a line!

Wrap Up

The amateur technical stock traders on our team keep telling me that commodities are a coiled spring ready for release… as they said to me, the “longer the base the bigger the eventual move up”. It’s been a drought in the junior mining space except if you happen to cover certain commodities (*cough cough* Gold). Sentiment has certainly tracked up over the last few months so we’ll see what the rest of this new (Australian) financial year brings!

Bloomberg Commodity Index

Feel free to drop me a line if you have any feedback/suggestions, or even if you’d just like to grab a coffee sometime.

Signing off for this quarter,

Gav

M: +61 488 448 028 (Mobile/WhatsApp)

E: [email protected]

W: www.modelanswer.com.au

Drop me a line on LinkedIn

*_ Seeing Gold is still hot and so is the kpop track Golden

If you’ve been forwarded this email, you can check out our CFO Labs archives and subscribe below for our quarterly updates.