Our Last Edition for the Year

Everyone talks about technology improving mining performance: but those who’ve tried to drive change know it’s far harder in practice. Mining is conservative and risk-averse, and technology only delivers value when it’s implemented well and aligned to how mining organisations actually work.

To close out the year, we invited two guest contributors to share their perspectives on how finance teams can help technology and innovation create real impact in mining: an area we’re passionate about, even if it’s not our core advisory focus:

We’ve also refreshed our quarterly mining finance dashboards:

Our offices will be closed over Christmas and New Year, from 25 December to 11 January.

Thank you to our clients and friends for a fantastic 2025. From the whole Model Answer team, Merry Christmas and Happy New Year!

Best WIshes for the Holiday Season!

How to Destroy the Value of Mining Technology Innovation

Thoughts Toward an Inversion Playbook for Mining Finance Leaders

“Invert, always invert.” – Charlie Munger (quoting Carl Jacobi)

Proven 10 % + NPV Impact!

You’ve seen these value propositions before, complete with confident modelling and technical justification:

20 %+ reduction in resource-drilling costs through AI-driven optimisation.

A one-year reduction in time to first metal.

5–10 %+ increase in metallurgical recovery through AI-enabled ore tracking.

10 %+ productivity improvement in drill–blast–load–haul operations through AI decision support.

Halve the unscheduled downtime on critical conveyors and virtually eliminate catastrophic failure.

On paper, these shifts in NPV can make or save a project. In practice, they usually don’t.

The real challenge isn’t proving technology innovation creates value, it’s preventing organisational friction from destroying it.

How to Make Sure That Value Disappears

At first glance, the claims are unbelievable. Enormous impacts for what might be a few hundred thousand dollars of consulting, software, or a mobile app. If it sounds too good to model, it probably is.

After 25 years in mining-technology innovation, I can confirm there are many reliable ways to ensure the promised value is never realised.

Personal risk avoidance

Decision-makers worry about being blamed if it fails — and occasionally if it succeeds (“why didn’t you fix this earlier?”). Committees offer safety in numbers, which is why they’re so effective at killing innovation.

KPI friction

People rarely welcome change that threatens their metrics. A planner rewarded for tonnes moved won’t slow down to reduce ore dilution. The result is quiet, everyday resistance and the deadly art of malicious compliance.

Process paralysis

Procurement and IT guard the gates. Their templates are designed for contract miners or enterprise software, not pilots. Ill-fitted contracts, high scrutiny, and endless approval loops delay projects six to eighteen months. By then, key sponsors move on and the window closes.

Innovation without owners

Innovation offices often become comfortable waiting rooms for ideas. If the site-level sponsor isn’t the mine manager or operations superintendent who owns the outcome, the project dies politely.

Downstream constraints

As Goldratt taught us, optimizing a non-bottleneck is a mirage:

Lower drilling costs don’t count if exploration, structure mapping, or hydrology data are compromised.

Shorter drilling timelines mean nothing if drilling wasn’t on the critical path.

A more precise dig plan adds no revenue if you can’t comply with it.

Reducing conveyor downtime is nice, unless that conveyor isn’t the constraint.

The pattern is consistent: each friction shaves a little from the promised NPV until the benefit is gone.

How to Accidentally Succeed: The Antidotes to Value Destruction

Against all odds, some innovations do succeed. They usually involve one or more of the following:

An existential threat

When the mine, project, or career is on the line, people act. Necessity aligns incentives faster than any governance framework.

The intrapreneur–entrepreneur alliance

Inside champions quietly remove internal roadblocks while the vendor adapts delivery to avoid them. The best partnerships are half art, half smuggling operation.

A senior sponsor who’s had enough

Now and then a seasoned CEO, CFO, or mine manager decides life’s too short for bureaucracy and simply forces the issue. Results follow.

Ownership mindset

Owner-operators with skin in the game think differently. They weigh risk and reward through the single lens of value creation.

True innovation cultures

A handful of miners treat controlled experimentation as normal. They know every source of value friction listed above and manage them deliberately. These are the mines where technology actually changes outcomes.

A Parting Thought

This piece is tongue-in-cheek, but the inversion is serious. Before chasing another double-digit NPV uplift, first model how much value will leak through people, process, and timing. Fix those, and the technology has a fighting chance.

If you still believe your mine can capture the upside, here’s a structured way to find out — and to test whether the new generation of AI tools can help you see the risks before they cost you real money.

Dr. Jason Price is the head of Strategic Growth at Atrico, a boutique corporate advisory firm specialising in mining technology company growth and transactions. Jason has been in the mining technology industry for 25 years and has a background in M&A, disruptive technology strategy, product management, financial analysis, economics, and anthropology (and a fan of the Oxford comma).

How finance leaders in mining can structure internal processes to drive innovation

The traditional CFO in mining has spent decades doing essentially one thing very well, which is protecting the balance sheet by saying no to anything that creates variance from baseline performance, and for good reason, given that mining operations are essentially money-making machines where stability has always been the core mandate.

But the CFO role is changing, and those who don't recognise this shift are becoming the primary bottleneck to their own company's competitiveness, not because they're doing anything wrong per se, but because the game itself has changed.

The old CFO worried about accounting principles, compliance, and ensuring stable earnings were delivered to shareholders. The new CFO, the one who is actually creating long-term shareholder value, focuses on capital allocation as a strategic weapon rather than just a governance function. McKinsey now characterises this evolved role as the "corporate equivalent of a venture capital investor," meaning someone who evaluates ideas, stages investment based on evidence, and explicitly compares innovation ROI against M&A and capital expansion alternatives.

How Procurement and KPI Structures Destroy Innovation Value

A technology vendor identifies a genuine productivity problem at a mine site, something with proven solutions and payback measured in months rather than years. The operational team wants it because they live with the problem every day. The business case stacks up. But then it enters the procurement process, and this is where the value starts leaking away.

Traditional procurement takes 6-12 months for technology purchases, which effectively kills pilot momentum because by the time approval finally comes through the operational sponsor who championed it has often moved on to another role, the implementation window has evaporated, and the project dies in a spreadsheet somewhere.

The real irony is that most of these projects sit in the $100,000-$200,000 range per site, which means they don't actually require board approval under most delegation frameworks, yet they get stuck anyway because the procurement templates were designed for contract miners or enterprise software, not technology pilots that need speed.

Then there's the KPI misalignment problem. Operational people rarely welcome change that threatens their metrics. And the IT challenges are equally problematic. Outsourcing arrangements quite often lead to implementation problems because no one in the outsourced structure has any incentive to change anything, and there's no provision for rapid innovation pilots.

Governance Frameworks CFOs Can Implement to Enable Innovation

Create a parallel procurement track for innovation spending.

This means establishing pre-approved vendor frameworks where technology providers can onboard once and then be contracted directly without competitive bidding. The key design principle is perpetual onboarding so suppliers of all sizes can join at any time, which keeps the framework current with emerging technologies. This approach enables pilot deployments within weeks rather than months.

Redesign delegated authority thresholds to match the actual risk profile of innovation spending.

Best-practice structures grant VP-level authority for $100K-$250K approvals without requiring escalation, with CFO authority extending to $2-40 million depending on company size. NeuGroup surveys show that senior management involvement in designing these thresholds correlates with 75% policy effectiveness versus 59% for top-down approaches.

Ring-fence innovation budgets at the executive level, with finance acting as the guardian of these protected funds.

The critical element is that when budget pressures emerge, the ring-fenced spend cannot be raided without senior approval. Technology leaders allocate around 26% of IT budgets to innovation versus 18% for baseline organisations, according to Deloitte, and the difference largely comes down to whether the innovation allocation is protected or gets consumed by operational demands.

Implement stage-gate governance that ties funding directly to evidence of progress.

Funding starts low and focuses on the most uncertain technical elements, then ramps up as projects prove viability through successive gates. Companies using structured stage-gate processes achieve 63-78% success rates versus 25-45% for ad-hoc approaches, because the discipline forces honest assessment rather than continued investment in projects that should have been killed earlier. The critical design element is that decision makers at each gate must be people who own resources and can make allocation decisions, not project sponsors.

Establish innovation-specific KPIs that measure learning velocity rather than commercial outcomes.

Learning velocity means tracking how many assumptions get validated or invalidated in a given timeframe, and the key insight is that an experiment is only a failure if nothing was learned. McKinsey's Three Horizons framework provides useful guidance here, where Horizon 1 core business optimisation measures ROI and efficiency, Horizon 2 adjacent opportunities should track adoption rates and pilot-to-scale conversion, and Horizon 3 transformational innovation requires learning velocity. Applying Horizon 1 metrics to Horizon 3 projects systematically kills breakthrough innovation.

There is no shortage of technology solutions with proven value propositions. What's missing is the internal architecture that allows these solutions to navigate from identification to implementation without being destroyed by friction.

The CFOs who architect these enabling structures are creating the conditions for good ideas to reach implementation, which is a fundamentally different orientation than the traditional gatekeeper function. Both orientations have value, but the balance needs to shift if mining companies are going to capture the productivity improvements that technology innovation can deliver.

Marina Baslina is a CMO and innovation strategist specializing in mining technology, and founder of Rocks ‘n’ Futures. She provides expertise in digital transformation and industry innovation adoption.

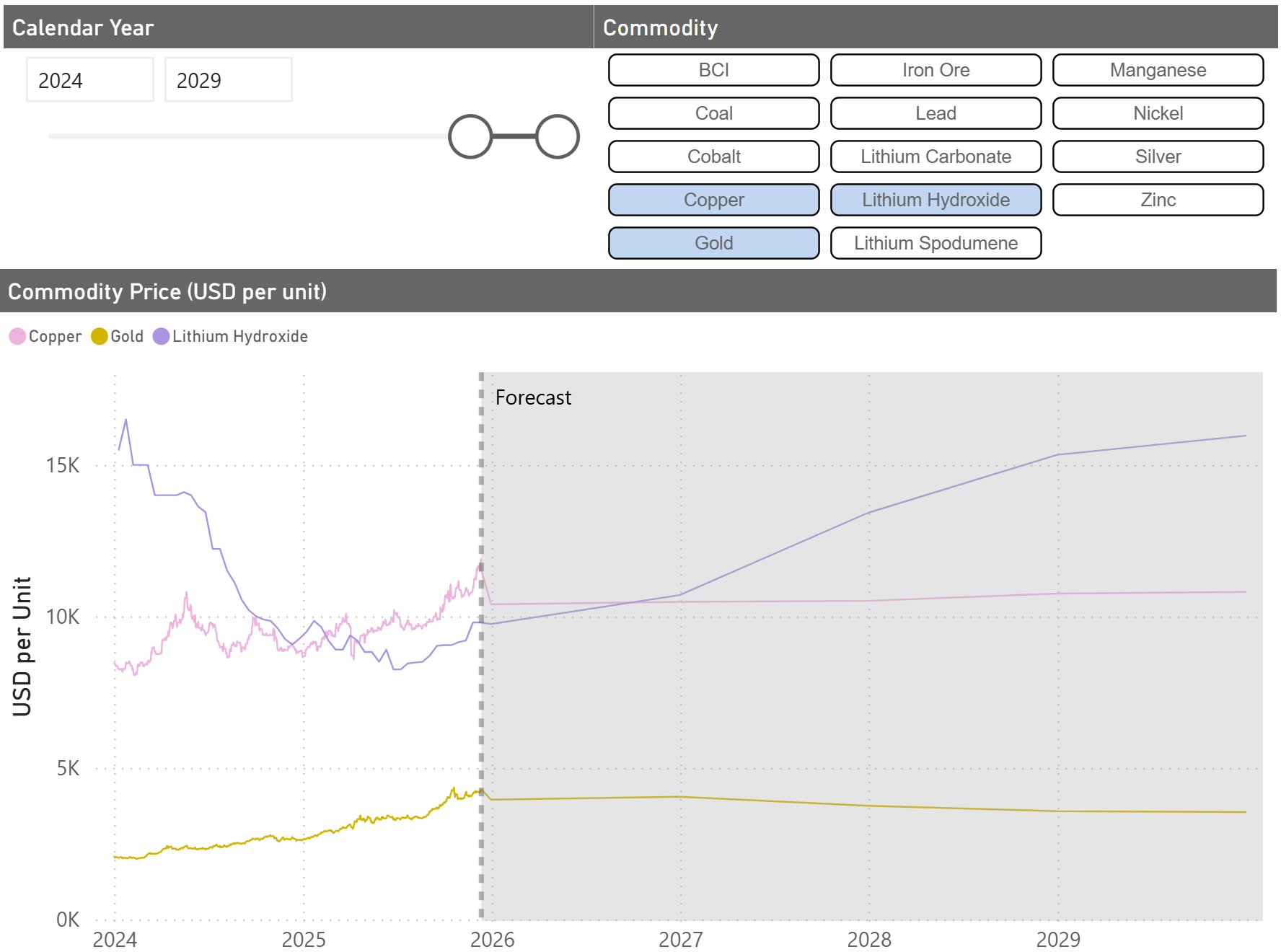

Quarterly Mining Finance Dashboard

We’ve updated our Mining Finance Dashboard for the last quarter (with data sourced up to the end of November). Our dashboard is an interactive way to look at:

Historical and forecast prices for a variety of commodities

Historical M&A mining transactions

Historical ECM mining transactions

Check out the dashboard here!

Are forecasts ever really meaningful…?

Mining Debt Transaction Dashboard

We’ve updated our Mining Debt Dashboard for the quarter. We’re considering reorganising the data and the way this dashboard works to give deeper insight. Drop us a line if you have any suggestions!

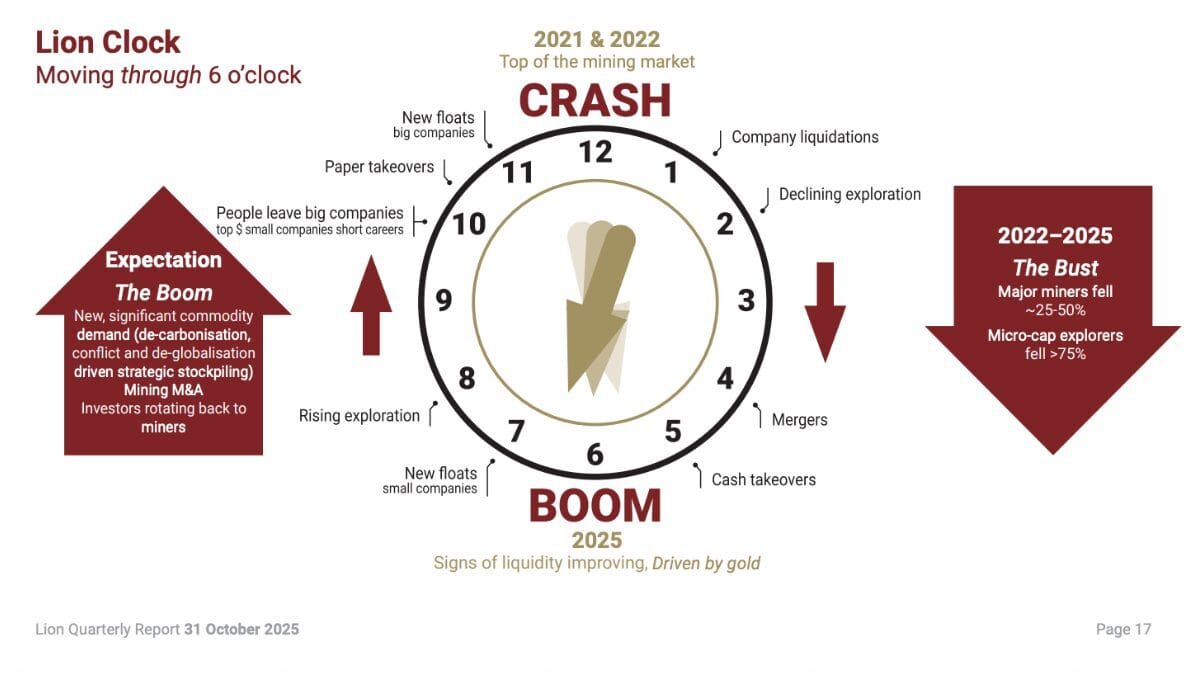

Bloomberg Commodity Index | Mining Clock

We leave you with the latest BCI chart and October’s Mining Clock from Lion Selection Group (ASX: LSX). Our chartist colleague tells us that even though prices may seem to have faltered over the last couple of weeks, the trend has broken out of a very long base and it’s lift off in progress!

Bloomberg Commodity Index: 5 Year View

Bloomberg Commodity Index: 1 Year View

Signing off for the quarter,

Gav

M: +61 488 448 028 (Mobile/WhatsApp)

E: [email protected]

W: www.modelanswer.com.au

Drop me a line on LinkedIn

If you’ve been forwarded this email, you can check out our CFO Labs archives and subscribe below for our quarterly updates.