Welcome to our Quarterly Update for Q3

Welcome to Model Answer’s CFO Labs email for the quarter. In this issue, we focus on how mines can be funded… with Strategic Investment!

We’ve also updated our mining finance dashboards for the quarter:

If you’re joining us for the first time, this is an email we send out (quarterly only) to share valuable resources and insights on Resources/Mining Finance with our community!

From Stuck to Funded: How Strategic Investors Unlock Mining Projects

Every mining project has its highs and lows: the excitement of discovery, the grind of feasibility studies, and too often, the dreaded “orphan period” where momentum stalls and funding looks out of reach.

But here’s the good news: projects don’t have to stay stuck. In our May session with the CFA Society Australia, Patrick Leung (Naust Capital) and I walked through 11 case studies showing how strategic investors can transform the outlook for a project, turning impossible funding gaps into credible pathways to FID.

From Sheffield’s textbook JV with Yansteel, to Core Lithium’s bold equity-only sprint, to Liontown’s creative Ford and LG funding structures, the lesson is clear: with the right partner, timing, and deal design, even the toughest projects can cross the line.

The stories reveal that success isn’t just about capital. It’s about win–win partnerships that bring credibility, offtake certainty, technical know-how, and balance sheet strength. The best strategics don’t just write a cheque, they solve the whole funding equation.

CFA Society: Strategic Investment Presentation

(Recorded May 2025)

Here’s the transcript if you want to read the discussion together with the presentation below!

Financing mining joint ventures: distinct challenges to project bankability

Thanks to Rowen Cross and Crux Law for this very relevant article. Here’s the Exec. Summary.

Great project, modest market cap, massive capex. This is a common conundrum in mining circles. The strategic partner is often seen as the panacea – a large conglomerate that brings balance sheet strength and experience developing similar projects around the globe… And in your case it is! The strategic partner is interested and offers to bring equity through an unincorporated joint venture (UJV) as the majority stakeholder, as well as other benefits (perhaps in the form of an offtake solution or construction expertise). All you need to do now is bed down the new arrangements.

While your partner has significantly reduced the funding requirement (and will often sole fund the project through to Final Investment Decision), mining projects are rarely fully funded by equity, and you will need to obtain project finance at some point. While more difficult than whole-of-project financing, it is possible to project finance a JV participant, even a minority joint venturer, but it is absolutely crucial to negotiate joint venture terms that are bankable. If you do not and project financing is unobtainable, then the panacea of the strategic partnership is illusory and a future of dilution awaits.

In this article we discuss the bankability issues unique to joint ventures and those crucial JVA terms that you must get right in negotiations to make sure your JV interest is bankable. The full article also includes a 101 on mining joint ventures, which outlines the joint venture structure and overlays it with a project financing framework.

Crux Law is Perth’s independent finance law firm, helping businesses navigate every stage of the debt capital lifecycle with clear, strategic legal advice. Drop Rowen a line at [email protected].

Quarterly Mining Finance Dashboard

We’ve updated our Mining Finance Dashboard for the last quarter (with data sourced up to the end of September). If you haven’t seen this dashboard before, it’s an interactive way to look at:

Historical and forecast prices for a variety of commodities

Historical M&A mining transactions

Historical ECM mining transactions

Check out the dashboard here!

Training Updates

We’re proud to share that we’ve successfully delivered two public training courses (“Modelling Foundations: Mining”) in August and October. A heartfelt thank you to everyone who attended. Your contribution and enthusiasm mean the world to us!

On the corporate front, we’ve recently conducted customised training programs for our clients across Australia and the Middle East. It’s been a pleasure working with organisations such as WesCEF, Rio Tinto and Manara Minerals to deliver impactful learning experiences tailored to their needs.

If you're looking to upskill your team with tailored training solutions, we’d love to hear from you, feel free to reach out!

Jeremy Ooi | Model Answer Training Partner

A few of the kind words shared by course participants

Mining Debt Transaction Dashboard

We’ve updated our Mining Debt Dashboard for the quarter.

In the last quarter we’ve seen debt and debt-like transactions that included:

Exploration and development funding costs ranging from 8% pa (convertible notes) to an effective interest rate of 44%+ pa.

Greenfield project funding ranging from 12% pa (restart project) through to 16%+ pa (plus warrants on top) with a mixture of fixed and floating (SOFR linked) structures.

Producers sourcing funding between ~5.6% pa (large Copper producer) to 15%+ pa (short term funding for a Vanadium producer under pricing pressure).

Wrap Up

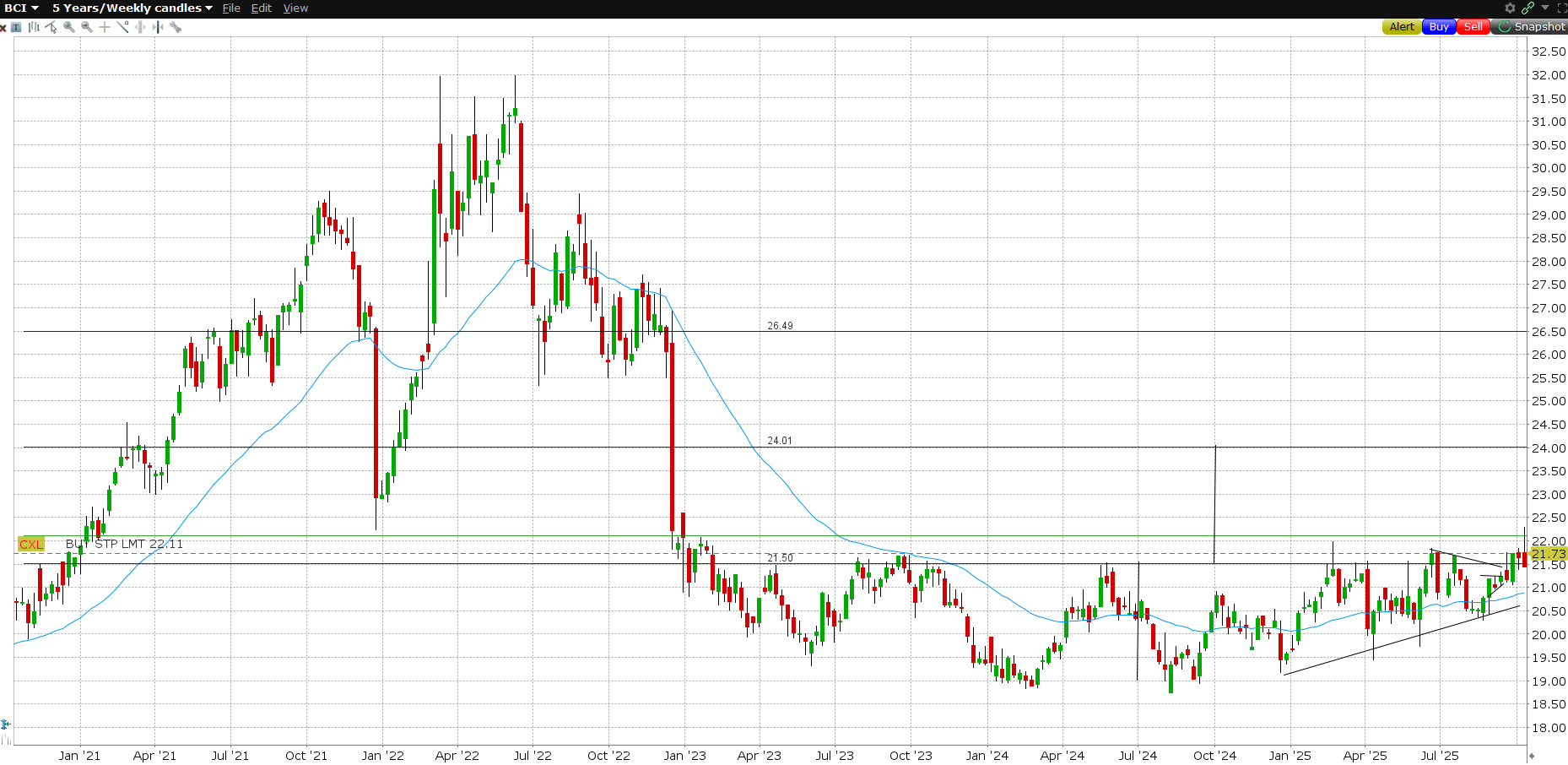

It’s been fascinating to watch general commodity prices trend up, with gold leading the way to crack the USD 4,000/oz mark. Perhaps our technical chartist colleague is right and the indices show that “with a big and long base”, a commodities boom is around the corner…!

Bloomberg Commodity Index

If you enjoyed this issue or even if you just want to grab a coffee and have a chat sometime, reach out and drop me a line.

Signing off for the quarter,

Gav

M: +61 488 448 028 (Mobile/WhatsApp)

E: [email protected]

W: www.modelanswer.com.au

Drop me a line on LinkedIn

If you’ve been forwarded this email, you can check out our CFO Labs archives and subscribe below for our quarterly updates.